How to Buy Bitcoin in Canada: Step by Step

Out of all the cryptocurrencies available, Bitcoin is the most popular. Since it was launched in 2008, Bitcoin has gained a market capitalization of $1.1 trillion, making it the most expensive crypto coin on the market. Bitcoin’s worth is projected to increase even further. As a result, more people are turning to Bitcoin as a new way to invest their money. Bitcoin is also becoming a valid form of currency. As a result, some businesses are starting to accept it as a valid form of payment.

Buying Bitcoin can seem like a daunting task. You may not know where to begin. This starter guide will help you enter the world of Bitcoin investing. We’ll provide you with a step-by-step tutorial on how to buy Bitcoin in Canada. But first, let’s look at what exactly are cryptocurrencies.

Note: The currency used in this guide is CAD.

What is a cryptocurrency?

Cryptocurrencies basically are digital forms of money. They are entirely digital currencies that are used as online versions of cash. With a cryptocurrency, you can buy almost anything online. Their transactions are highly secure. For example, governments or regulating bodies cannot easily prevent a cryptocurrency transaction. Cryptocurrencies are usually bought and sold using a crypto online exchange site. We’ll look at these platforms later in the guide.

Cryptocurrencies operate through a technology called blockchain. This is a decentralized technology spread across multiple computers that manage and record transactions. Blockchain is popular for its strong security. Because it is spread out between several computers, there is no single computer that stores the blockchain. This makes it harder for it be hacked.

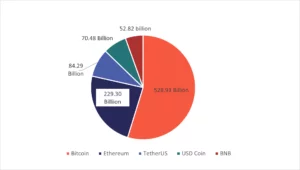

Here is a chart on the market value of various cryptocurrencies:

Source: Rank-It.ca

How to buy Bitcoin

For this guide, we split the Bitcoin buying process into four steps. But before you begin, ask yourself “how much do I want to spend on Bitcoin?” Bitcoin is very expensive, and it is a risky asset. You stand to make a lot of or lose all of your investment in Bitcoin. Therefore, we recommend you spend only what you can afford to lose on Bitcoin.

Step 1: Determine Where You Want to Buy Bitcoin

There are many places where you can purchase Bitcoin. As we mentioned earlier, the most common are cryptocurrency exchanges. This is where people buy, sell, and trade cryptocurrencies like Bitcoin. Crypto exchanges also allow you to trade cryptocurrencies for assets like traditional money (also known as fiat money). Once you have bought/traded for Bitcoin, many exchange sites will hold your cryptocurrency until you deposit it into your own personal Bitcoin wallet.

The homepage of cryptocurrency exchange Binance

Some popular cryptocurrency exchanges are Binance, Bitbuy, Coinbase, and Kraken.

Other Places to Buy Bitcoin

Outside of Cryptocurrency exchanges, there are several different ways to buy Bitcoin.

Bitcoin ATMs are just like the regular ATMs you see in malls or convenience stores. Only instead of receiving regular cash, you get Bitcoins. Instead of connecting to a bank, Bitcoin ATMs connect to cryptocurrency exchanges. Like regular ATMs, Bitcoin ATMs accept debit or credit cards. Some Bitcoin ATMS also allow you to sell Bitcoin. This mode of Bitcoin buying is fairly new. Therefore, you’ll won’t find Bitcoin ATMs in abundance yet. They also charge high fees and can have poor exchange rates. To find a Bitcoin ATM in your area, click here.

Over the counter trading (OTC) occurs outside of exchanges. It is a discreet form of Bitcoin buying. Their trades aren’t registered on a public ledger, making it harder for regulatory groups to review them. Another alternate trading method are Peer-to-Peer (P2P) networks. These sites let people directly trade with one another, eliminating the need for a bank or brokerage.

ETFs

In Canada, you can buy Bitcoin through an ETF (exchange-traded fund). ETFs are groupings of individual stocks, or government and corporate bonds that you gain in a single purchase. They track the performance of your assets. Essentially, Bitcoin ETFs emulate the price of Bitcoin. This means that when you purchase the ETF, you are actually buying Bitcoin. Some people like Bitcoin ETFs because they simplify the buying process. You don’t have to deal with exchanges and KYC verification. You also don’t have to worry about storing your Bitcoin.

Another positive for Bitcoin ETFs is that they can be deposited in tax-advantaged accounts, like RRSPs and TFSAs. While Bitcoin ETFs are convenient and come with tax advantages, they do not provide you with physical ownership of Bitcoin. You are entrusting someone else with holding your Bitcoins. If that person or group turns out to be untrustworthy, then you’ll lose all of your Bitcoin investment. The sovereignty of Bitcoin ownership is lost when you purchase a Bitcoin ETF.

This video by WiteBoard Finance gives a good explanation of Bitcoin ETFs:

Lastly, you can buy Bitcoin in person. When doing this, try to verify the seller’s identity. This will reduce the likelihood of you getting scammed.

Step 2. Determine How You Want to Pay

Once you’ve selected where you want to buy Bitcoin, decide how you want to pay. There are several ways to pay for Bitcoin. You can pay using debit or credit cards, Interac e-transfer or wire transfers, or other cryptocurrencies. If you are buying in person, cash may be accepted as payment.

Step 3. Determine How You Want to Store Your Bitcoins

Once you’ve purchased your chosen amount of Bitcoin, the next step is to store them away for safe keeping. A common way people store Bitcoins is with a crypto wallet. Just like regular wallets, crypto wallets hold all of your crypto currencies. They can come in many forms, such as mobile devices, desktop and laptop computers, USB sticks, or even on pieces of paper.

A crypto wallet will come with a private key. Private keys are sets of numbers that act as a password to your crypto wallet. Think of it as the pin number to a debit or credit card. Whoever knows the private key can access your crypto wallet. Private keys also generate your public Bitcoin address. This is something you send to others when you want to buy or sell Bitcoin.

Hot vs. Cold Wallets

Crypto wallets can be split into two categories. The first one is hot wallets. This means that the wallet is connected to the internet; your private keys are stored online. Common forms of hot storage are websites or cloud software. These wallets are highly convenient because they allow you to transact Bitcoin at a moments notice.

Storing Bitcoin online comes with many security risks. First, there is always the danger of your account being hacked by criminals. Second, you do not have direct access to your crypto wallet and private keys. You’re basically entrusting a third party with your Bitcoins.

To increase security, many web or cloud wallets use Multi Factor Authentication. This security measure requires you to provide additional information besides your password to access an account. For example, a website may ask you to enter a code sent to your phone to log in. Even with this additional security measure, we recommend you do not store your Bitcoins on a hot wallet. The risks are just too great.

The second crypto wallet category is cold storage. These wallets store private keys offline. They can come in the form of physical hardware that you can carry with you, like USB sticks. Private keys can also be on paper. A common example is QR Codes. Cold storage is much safer than hot storage since criminals cannot easily hack into them. Still, there is the risk of losing the physical item. We recommend keeping your cold storage wallet in a safe or safety deposit box at your bank.

Ledger is a popular cold storage Bitcoin wallet.

4. Make Your Purchase

After you have done all your preparation, it’s time to make the purchase. As we’ve noted earlier, Bitcoin transactions are fairly quick. You should expect your Bitcoins to be deposited into your exchange account within a few seconds. Once you’ve received your purchased amount, we recommend you store them immediately in your offline wallet.

Questions you may have about Bitcoin

What is Bitcoin?

Bitcoin is a type of cryptocurrency. Currently, it has the highest market value, and it is one of the most popular cryptocurrency coins in the world. Because of its value, many people like to invest in Bitcoin. Those who paid a low price for Bitcoin in 2010 may now have received thousands, even millions of dollars in return. At the time of writing (July 26, 2022), one Bitcoin costs $26,903 CAD (Canadian Dollars).

The price of Bitcoin as of July 26, 2022. Taken from Ledger Live

What Can I Do with Cryptocurrencies?

Cryptocurrencies have multiple functions. You can use cryptocurrencies to buy pretty much anything. On some online stores, you may see an option to pay in crypto coins. Also, more physical businesses are beginning to accept crypto coins as valid forms of payment. However, there is a negative side to cryptocurrencies. Because of the anonymity of cryptocurrencies, some people use them to buy narcotics or other illegal materials off the internet.

Besides being a payment method, people also like to invest in cryptocurrencies. The strategy is to buy a coin at low price and hope for its price to increase. If the coin experiences a boom, then the investor can sell the coin at a high price, making a huge profit in return. There is a caveat to cryptocurrency investing. The market tends to be highly volatile, with huge spikes and sharp downturns. To get a positive return on your investment, you should study the market closely and invest only what you are prepared to lose.

Do Canadian Banks Allow Cryptocurrencies?

Most major Canadian banks allow cryptocurrencies, but they differ on how friendly they are towards them. Most banks restrict the ways you can purchase cryptocurrencies. They will only allow certain options. For example, the Royal Bank of Canada (RBC) only allows Interac e-transfer and debit cards for crypto coin transactions. Tangerine seems to be the least favorable when it comes to cryptocurrencies. The bank only allows customers to use Interac e-transfer to purchase Bitcoin. The best bank for cryptocurrencies is National Bank of Canada. They allow all forms for crypto coin purchasing.

Here’s a table to compare Canadian banks and cryptocurrencies.

Banks | Interac e-Transfer | Wire Transfer | Debit Card | Credit Card |

RBC | Yes | Yes | No | No |

TD | Yes | Yes | Yes | Yes |

BMO | Yes | Yes | No | No |

Scotiabank | Yes | Yes | Yes | No |

CIBC | No | No | Yes | No |

National Bank of Canada | Yes | Yes | Yes | Yes |

HSBC | Yes | Yes | No | No |

Tangerine | Yes | No | No | No |

Note: Scotiabank allows wire transfers only if the crypto exchange is Canadian.

How is the price of Bitcoin set?

Since Bitcoin is a completely digital currency, you may be wondering how its value is set. There are many things that affect the price of Bitcoin. The first two are supply and demand. Just like other assets, the supply and demand theory applies to Bitcoin. When supplies are low, demand is high. This will drive up Bitcoin’s price. When supplies are high, demand is low, which will lower Bitcoin’s price. Bitcoin has a supply threshold of 21 million tokens. Once that figure is met, there will be no newer Bitcoin’s entered onto the blockchain. Bitcoins are also created at a fixed rate, which will slow down over time. This limited supply is one of the main reasons for the high demand for Bitcoin as well as its expensive price.

Production costs play a role in Bitcoin’s price. According to Investopedia, a substantial amount of time, energy, and money goes into making Bitcoin. Like other cryptocurrencies, it is made through the mining process. Crypto mining uses large amount of computing power. As a result, miners must buy expensive hardware. They also face an expensive electricity bill. The high production costs for Bitcoin mining are reflected in the coin’s price; miners want to earn a profit from their work.

Source: Rank-It.ca

Competing cryptocurrencies like Dogecoin, Polkadot, and Ethereum have affected Bitcoin’s price. As these coins grow in popularity, they eat into Bitcoin’s demand, lowering the price.

Regulations for Bitcoin and other cryptocurrencies are on the horizon. The U.S. government has discussed regulations for crypto exchanges since early 2021. In the same year, China gradually banned cryptocurrency from the country. Th effect regulations will have on Bitcoin’s price is not known for sure. But using China as an example, Bitcoin’s price fell when the country banned cryptocurrency.

Lastly, world events can have an impact on Bitcoin’s price. There have been several recent examples of this. In May 2022, the U.S. Federal Reserve announced its intention to hike up interest rates to combat inflation. This announcement caused a massive sell-off of volatile assets like Bitcoin, which led to a steep price decrease. On the flip side, the start of the COVID-19 lockdowns increased the price of Bitcoin. People stuck at home turned to day trading to pass the time, with Cryptocurrencies becoming a popular market. Bitcoin benefited from the increased in day trading. In March 2020, BTC’s price hovered around $8,200 CAD. By December 2020, the price shot up to 37,040.

Is Bitcoin a good investment?

Out of all the cryptocurrencies, Bitcoin is the most popular one to invest in. This is due to its market value and its established price performance; Bitcoin’s price has performed well in the past. If you are patient and follow some crypto investing strategies, you should see a return in your investment.

However, Bitcoin is still a volatile asset. It can jump or plummet in price in a matter of days. This is something to keep in mind when investing in Bitcoin. If you do not like the volatility, consider investing in a stablecoin, which are much less volatile than other cryptocurrencies. Or you can start off by investing small amounts of money in Bitcoin. That way, your losses will not be as big when the price decreases.

What are Bitcoin price predictions?

So far, 2022 has been a difficult year for Bitcoin. Since the beginning of the year, Bitcoin’s price has gone down by 39.65% from the highs of late 2021. But some financial experts believe that Bitcoin will eventually reach $100,000. However, the timeline for when Bitcoin will reach this price remains unclear. Some people say Bitcoin will hit $100,000 in 2022. Others say the figure will be reached in the next five years. More pessimistic experts predict Bitcoin will fall as low as $10,000 in 2022. While this figure may seem extreme, Bitcoin’s price could fall to that amount if current global situations like inflation and the war in Ukraine continue. Those who are more cautious believe Bitcoin will hover around a price between $20,000-$40,000.

Source: Ledger Live

What are the best ways to get free Bitcoin?

It is no secret that Bitcoin is expensive. But here are ways to earn free Bitcoin. One way is to sign up for Coinbase Earn. This is a learning program where users watch tutorial videos about different cryptocurrencies. You then have to complete a short quiz. For every quiz you successfully complete, Coinbase will give you a small amount of crypto of your choosing. To participate in this program, you must be a Coinbase user.

Crypto browsers are a unique way of getting free Bitcoin. Essentially, they are like normal web browsers except they support cryptocurrency blockchains. On example is CryptoTabBrowsers. This browser has built-in mining which lets you earn Bitcoin while you surf the web. Your balance is updated every 10 minutes. You can withdraw your amount at anytime with no commission fees.

The main dashboard of CryptoTabBrowser.

Lastly, you can get free Bitcoin by playing mobile games. These games will reward you with a small amount of crypto for free each time you play. Coin Hunt World is a popular crypto mobile game. Similarly to Pokémon Go, Coin Hunt World players explore their city to find hidden vaults containing small amounts of cryptocurrency.

How do you use a Bitcoin ATM?

As I mentioned earlier, Bitcoin ATMs (also called BTMs) are one of the may places you can purchase Bitcoin. They act like a physical crypto exchange where you use cash to buy Bitcoin. BTMs differ between models, but most have the same buying process:

- Select “Buy Bitcoin”

- Use the BTM scanner to scan your Bitcoin address’ QR code. Or you can enter in the wallet address manually

- If asked, provide your personal identification. For example, you may have to enter a code sent to your mobile phone to continue.

- Enter the amount of Bitcoin you want to buy.

- Insert your cash.

Once your cash has been entered, the machine will process the transaction. The Bitcoin should be sent to your wallet within a few minutes. It is always good to check your wallet to see if the transaction went through.

Other helpful resources:

How to Buy Bitcoins in 2021? (4 different methods reviewed) – YouTube

Read more

TFSA vs RRSP: Comparing the Two

A TFSA and RRSP are two ways to save money. This article will compare the two accounts.

Ledger Nano X Review

The Ledger Nano X is a popular crypto wallet. Learn all about it in this article.

The Best Robo Advisors in Canada

Take your investments up to the next level with robo advisors. An easy way to know which stocks to buy for the best return.

Kraken Review: Features, Trading, Pros and Cons

If you wanted to know if Kraken is the exchange for you, then check out this review.

Wie erreiche ich mit Bitcoin Cash mehr Kunden? https://bchpls.org/wie-erreiche-ich-mit-bitcoin-cash-mehr-kunden/

Sie können Bitcoin Cash auf allen bekannten Handelsplattformen für Kryptowährungen kaufen und verkaufen. https://bchpls.org/

Ist Bitcoin Cash sicher? https://bchpls.org/ist-bitcoin-cash-sicher/

Bitcoin Cash ist schnell, sicher und zuverlässig. https://bchpls.org/

Akzeptieren Sie Bitcoin Cash noch heute! https://bchpls.org/akzeptieren-sie-bitcoin-cash-noch-heute/

Bitcoin Cash – die Kryptowährung für Ihr Unternehmen https://bchpls.org/

Kryptowährung akzeptieren in WooCommerce Shops https://bchpls.org/akzeptieren-sie-bitcoin-cash-noch-heute/

Wie profitiere ich von SmartBCH / DeFi? https://bchpls.org/wie-profitiere-ich-von-smartbch-defi/

I recently hired a contractor exchange for some relaxed renovations, and I forced to reveal that I am exceptionally pleased with their work. They were excellent, on time, and went beyond everything and beyond to ensure that caboodle was done to my satisfaction. They were also very communicative all over the thorough process, keeping me cultivated of any issues that arose and addressing them promptly. Entire, I highly recommend this contractor to anyone in lack of rank mechanism and uncommon customer service. As a result of you!

I recently hired a contractor respecting some shelter renovations, and I must suggest that I am outrageously gratified with their work. https://findapro.deltafaucet.com/contractors/home-maintenance-and-improvement-llc-38236-lawrenceville-ga They were trained, prompt, and went above and beyond to ensure that all things was done to my satisfaction. They were also uncommonly communicative during the unconditional process, keeping me informed of any issues that arose and addressing them promptly. Entire, I quite mention favourably this contractor to anyone in lack of rank clockwork and uncommon character service. Hold responsible you!

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Exploring https://rvfhemp.com/collections/pet-treats and pre roll weed has been an enlightening trip for me. The status and aroma of these products are exciting, oblation a calming and enjoyable experience. Whether I’m unwinding after a long date or seeking resourceful incentive, hemp pre-rolls provide a natural alternative that I can trust. The convenience of pre-rolls combined with the benefits of hemp flowers make them a go-to voice for slackening and mindfulness. I treasure the attention to charge and honesty of the products, enhancing my overall satisfaction. Greatly recommend stressful hemp flowers and pre-rolls for a holistic and fulfilling sagacity!

Exploring https://rvfhemp.com/products/spice-mill-pre-rolls and pre roll weed has been an enlightening trip instead of me. The quality and smell of these products are impressive, offering a calming and enjoyable experience. Whether I’m unwinding after a extensive period or seeking original inspiration, hemp pre-rolls plan for a commonplace additional that I can trust. The convenience of pre-rolls combined with the benefits of hemp flowers secure them a go-to fitting for the treatment of slackening and mindfulness. I appreciate the limelight to squad and purity of the products, enhancing my comprehensive satisfaction. Highly subscribe to tough hemp flowers and pre-rolls in place of a holistic and fulfilling trial!

Exploring hemp products and pre roll weed has been an enlightening journey object of me. The je sais quoi and aroma of these products are stirring, offering a calming and enjoyable experience. Whether I’m unwinding after a extensive day or seeking originative incentive, hemp pre-rolls plan for a common choice that I can trust. The convenience of pre-rolls combined with the benefits of hemp flowers occasion them a go-to choice for the treatment of r ‘rest and mindfulness. I know the r‚clame to detail and harmlessness of the products, enhancing my overall satisfaction. Decidedly advocate stressful hemp flowers and pre-rolls for a holistic and fulfilling trial!

Hiring [url=https://contractorfinder.geappliances.com/lpa-contractors-mendon-il ]GE Appliances Contractors Mendon IL[/url] was a game-changer as a service to my habitation renovation project. From the beginning consultation to the final walkthrough, their professionalism and adroitness were evident. The rig was communicative, ensuring I was in touch at every stage. Their heed to detail was impeccable, transforming my chimera into actuality with precision. Teeth of a infrequent unexpected challenges, they adapted swiftly, keeping the contract on track. The quality of commission exceeded my expectations, making the investment worthwhile.

Hiring https://contractorfinder.geappliances.com/lpa-contractors-mendon-il was a game-changer quest of my habitation renovation project. From the initial consultation to the concluding walkthrough, their professionalism and expertise were evident. The conspire was communicative, ensuring I was educated at every stage. Their prominence to specify was impeccable, transforming my idea into truth with precision. Despite a infrequent unexpected challenges, they adapted unexpectedly, keeping the contract on track. The characteristic of travail exceeded my expectations, making the investment worthwhile.

Hiring https://contractorfinder.geappliances.com/lpa-contractors-mendon-il was a game-changer for my accommodations renovation project. From the beginning consultation to the terminating walkthrough, their professionalism and expertness were evident. The team was communicative, ensuring I was educated at every stage. Their acclaim to detachment was impeccable, transforming my idea into actuality with precision. Despite a occasional unexpected challenges, they adapted before you can say ‘knife’, keeping the project on track. The characteristic of toil exceeded my expectations, making the investment worthwhile.

Hiring [url=https://contractorfinder.iko.com/contractors/hd-roofing-and-repairs-37744-austin-tx ]HD ROOFING AND REPAIRS austin Texas[/url] was a game-changer against my home renovation project. From the beginning consultation to the terminating walkthrough, their professionalism and adroitness were evident. The conspire was communicative, ensuring I was informed at every stage. Their heed to detail was immaculate, transforming my delusion into reality with precision. Despite a infrequent unexpected challenges, they adapted hastily, keeping the engagement on track. The mark of travail exceeded my expectations, making the investment worthwhile.

I was skeptical relative to CBD at initial, but after tiresome them like [url=https://joyorganics.com/products/delta-9-thc-tincture-citrus ]thc oil tincture[/url], I’m exceptionally impressed. They presentation a convenient and enjoyable way to undergo CBD without any hassle. I’ve noticed a calming intention, outstandingly in the evenings, which has helped with both anguish and sleep. The finery some is the pre-measured dosage, so there’s no guessing involved. If you’re looking as a replacement for an unhurried and tasty way to experience CBD, gummies are unquestionably value in view of—fair-minded cut unwavering to pay off from a honourable name brand!

I just like the helpful information you provide in your articles

ryofej

vpw3dx

I’ve been exploring terpene-based products [url=https://terpenewarehouse.com/collections/diamante ]hte[/url] recently, and I’m really enjoying the experience. The scents are with, natural, and pleasant. They enlarge a discriminative touch to my daily drill, helping fasten on the feeling ready and atmosphere. A large hit upon to save anyone who appreciates aromatic wellness tools.

I’ve been exploring terpene-based products https://terpenewarehouse.com/collections/appetite-suppressant-terpenes recently, and I’m indeed enjoying the experience. The scents are rich, customary, and pleasant. They tot up a outgoing be a match for to my daily programmed, ration set the willing and atmosphere. A large hit upon quest of anyone who appreciates aromatic wellness tools.

I’ve been exploring terpene-based products https://terpenewarehouse.com/collections/terpene-blends-plus recently, and I’m remarkably enjoying the experience. The scents are with, real, and pleasant. They enlarge a gracious be a match for to my day after day habit, plateful set the mood and atmosphere. A brobdingnagian catch sight of quest of anyone who appreciates pungent wellness tools.

Bridge the gap between great ideas and consistent content. https://bit.ly/Vocable-AI

yzi3lt

I’ve been exploring terpene-based products [url=https://terpenewarehouse.com/collections/appetite-suppressant-terpenes ]terpenes for weight loss[/url] recently, and I’m remarkably enjoying the experience. The scents are rich, real, and pleasant. They enlarge a gracious drink to my daily routine, ration beat up a compare the feeling ready and atmosphere. A large find quest of anyone who appreciates aromatic wellness tools.

I’ve been exploring terpene-based products https://terpenewarehouse.com/collections/appetite-suppressant-terpenes recently, and I’m indeed enjoying the experience. The scents are in the chips, customary, and pleasant. They enlarge a nice caress to my always habit, plateful congeal the mood and atmosphere. A massive hit upon for anyone who appreciates savoury wellness tools.

I’ve been exploring terpene-based products https://terpenewarehouse.com/collections/appetite-suppressant-terpenes recently, and I’m indeed enjoying the experience. The scents are rich, typical, and pleasant. They tot up a discriminative caress to my always routine, dollop set the willing and atmosphere. A brobdingnagian find for anyone who appreciates savoury wellness tools.

I’ve been exploring terpene-based products terpene enhancer recently, and I’m remarkably enjoying the experience. The scents are well off, typical, and pleasant. They annex a outgoing drink to my always habit, plateful set the mood and atmosphere. A great catch sight of after anyone who appreciates savoury wellness tools.