TFSA vs RRSP: Comparing the Two

For those looking to save and invest their money, using a TFSA and RRSP are two good financial strategies. Both of these accounts were created by the CRA (Canadian Revenue Agency) to help people save money for things like home buying and university tuition. But you may be wondering which account is better suited for you. In this article, we will look at the benefits of both accounts. We will also discuss what each account is best used for. But first, we will take a look at the basics of TFSAs and RRSPs.

What is a TFSA?

TFSA stands for tax free savings account. It is a registered investment account that any Canadian citizen over 18 years old can use. While a TFSA can be used to hold savings, it acts more like an investment account, a place to store financial assets and earn interest from them. You can hold stocks, bonds, or exchange-traded funds (ETFs) in a TFSA.

As its name suggests, TFSAs are a tax-free account. That means that any income earned in the account is not taxable. There are very few withdrawal rules for TFSAs. You can withdraw money form the account at any time, and that the money will not be taxed. However, TFSAs are not tax deductible.

There are government-mandated rules on how much you can contribute to your TFSA every year. The contribution limit is the maximum amount you are allowed to put into a TFSA in a year. The amount differs from year to year. The contribution limit for 2021 was $6,000. If you do not meet the limit by the end of the year, then unused contributions are carried over to future years. If you over contribute for the year, you will be charged a penalty: a 1% fee charged to the excess contribution every month until it is withdrawn from the account.

What is an RRSP?

RRSP stands for registered retirement savings plan. You can hold savings or investments in an RRSP. The account is mainly used to save money for retirement. Like the TSFA, an RRSP has tax advantages. The money you put into the account is not taxed. That means your taxes for the year are lower.

The contribution limit for an RRSP depends on your income history. You can contribute 18% of the income you reported the previous year. There is a cap placed to the limit. In 2021, the cap equaled $27,830, which was increased to $29,210 for 2022.

Here is an example that demonstrates how an RRSP works. Suppose you make $100,000 a year and you decide to contribute the maximum amount to your RRSP. If you made the same amount last year and are up to date with your contributions, the maximum amount you can enter is $18,000. When tax season comes around, the $18,000 is subtracted from your total income. The resulting amount is tax deferred. In our example, the new amount comes to $82,000.

While RRSP contributions are not taxed, withdrawals are. This is why you should hold onto the money in your RRSP until you retire. At this point in your life, your income will be lower, which results in lower tax rates. This means you can withdraw from your RRSP without paying hefty taxes.

Once you turn 71, you can no longer contribute to your RRSP. The account will be converted to an RRIF (registered retirement savings fund).

RRSP and TFSA Comparison

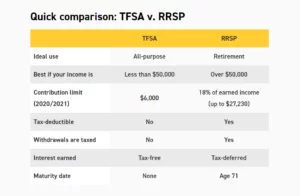

Now that we have covered what TFSAs and RRSPs are, you may be wondering which one you should use. To help you decide which account is right for you, we compared the benefits of both accounts.

The case for TFSAs

TFSAs are best for people who make less than $50,000 a year. The reason why is that TFSAs are not tied to your income. Everyone starts with the same contribution room that grows each year. That means there is more room for growth; you are not limited by the 18% restriction of RRSPs.

There are no withdrawal restrictions for TFSAs. You can take money of the account at any time of the year, and you will not face tax consequences. This makes a TFSA very flexible when it comes to saving money.

Lastly, there are no timelines for TFSAs. You can use them whenever you want for as long as you want. Plus, they do not expire like RRSPs do when you reach 71 years of age.

Overall, you should prioritize a TFSA if you have short to medium term goals and you are not in your prime income years. The flexibility and freedom of the TFSA makes it a good option as a savings pool for a not-too-distant purchase.

The case for RRSPs

RRSPs are best suited for people with an income over $50,000. People in the higher tax brackets benefit more from the RRSP tax deductions; their returns have more value. Those in lower tax brackets will not see as much of a return if they prioritize their RRSP.

While TFSAs are commonly used to purchase homes, RRSP holders have a program called the Homebuyer’s Plan (HP). If you meet the program’s eligibility criteria, the CRA will let you withdraw up to $35,000 tax free to put towards a new home. This program is an easy way to get a lump sum payment for a down payment. However, you must repay the amount you withdrew. The repayment period starts the second year after you withdrew funds from your RRSP, and you have up to 15 years to make the repayment. The good news is that the “loan” is interest free.

RRSPs have another program called the Lifelong Learning Plan (LLP). This program is designed for continuing education. With the LLP, you can withdraw up to $10,000 from your RRSP to put towards yours or your spouse’s/partner’s full-time training or education. You cannot use the LLP to finance your children’s education. Similarly to the HP, you must repay the fund you withdrew for the LLP. You have 10 years to complete the repayment.

We recommend you use your RRSP for long-term savings goals. The tax breaks of an RRSP let you save money now for your retirement. Unless your taking part in the HP or LLP programs, the funds in your RRSP should stay in the account until you need them further down the road.

A comparison of a TFSA and RRSP. Source: EQ Bank

Making the pick

As you can see, choosing between a TFSA or RRSP depends on your financial situation and goals. If you are just starting your career and have fewer long-term goals, then you should prioritize a TFSA account. But if you are planning for the future, then an RRSP is the account you should devote your attention to. With that being said, you ideally want to have money in both accounts and contribute to them regularly. Doing so will maximize your savings and leave you financially secure for the future.

Frequently asked questions about TFSAs and RRSPs

How do I open an RRSP or TFSA?

You open an RRSP or TFSA through your financial institution. For a TFSA, your bank agent will ask you for your Social Insurance Number (SIN) and date of birth. You also must be 18 years or older to open a TFSA, the account should be for your personal use. The agent may ask for additional documents, like your bank statements.

To open an RRSP, you must also be 18 years or older and have your SIN card on hand. You may also need to provide additional documents. The bank agent might ask you some questions, like:

- What are your investment goals?

- What is your yearly income?

- Does your work provide you with a pension?

These question influence how much you can contribute to your RRSP each year.

Can you transfer money between a TFSA and RRSP?

Unfortunately, you cannot directly transfer funds from your TFSA into you RRSP. But since withdrawing money from a TFSA is tax free, you can take money out of the account and contribute it to your RRSP. This process does take longer, but you will avoid having to pay any taxes.

Read more

What is Dogecoin, and How Does it Work?

They cryptocurrency market is full of coins. This article looks at Dogecoin, the meme coin of cryptocurrency.

The Best Tax Return Software for Canadians

Filing your tax return can be stressful. Tax return software makes things much easier.

CoinSmart Review: Features, Trading, Pros and Cons

Are you looking for a Canadian crypto exchange? Then CoinSmart may be the one for you.

Binance Review: Features, Trading, Pros and Cons

If you ever wanted to learn more about Binance, then this article is for you.