Coinbase Review: Features, Trading, Pros and Cons

Coinbase is one of the biggest and most popular cryptocurrency exchanges in the world. Even though this exchange is geared towards U.S. customers, Coinbase has many great services for Canadian and other international users. Outside of the main trading platform, Coinbase offers additional services.

If you want to learn more about Coinbase, then this is the article for you. In this review, I will cover the basics of Coinbase as well as share my experience using the exchange. Plus, I’ll answer some frequently asked questions about it. To kick things off, here is a brief overview of Coinbase.

Overview

Coinbase Specs

100+ cryptocurrencies supported |

89 million users worldwide |

Two trading platforms |

Has NFT marketplace |

Fees: 1.49%-3.99% |

Has mobile app |

Has extra incentives when you sign up |

Coinbase was founded in 2012 and has since grown to become one of the major crypto exchanges in the world. It’s userbase totals 89 million people with $278 billion in assets. Coinbase provides over 100 tradable coins like Bitcoin, Ethereum, and stablecoins like Tether. Additionally, many fiat currencies are supported by the platform. Coinbase allows various payment methods, but some are restricted based on the country you live in. In Canada, users are not allowed to link their bank account to Coinbase. Canadians are also unable to Interac e-transfer to make purchases. The only accepted payment method is with a debit/credit card. Canadians can only use PayPal to withdraw funds from Coinbase.

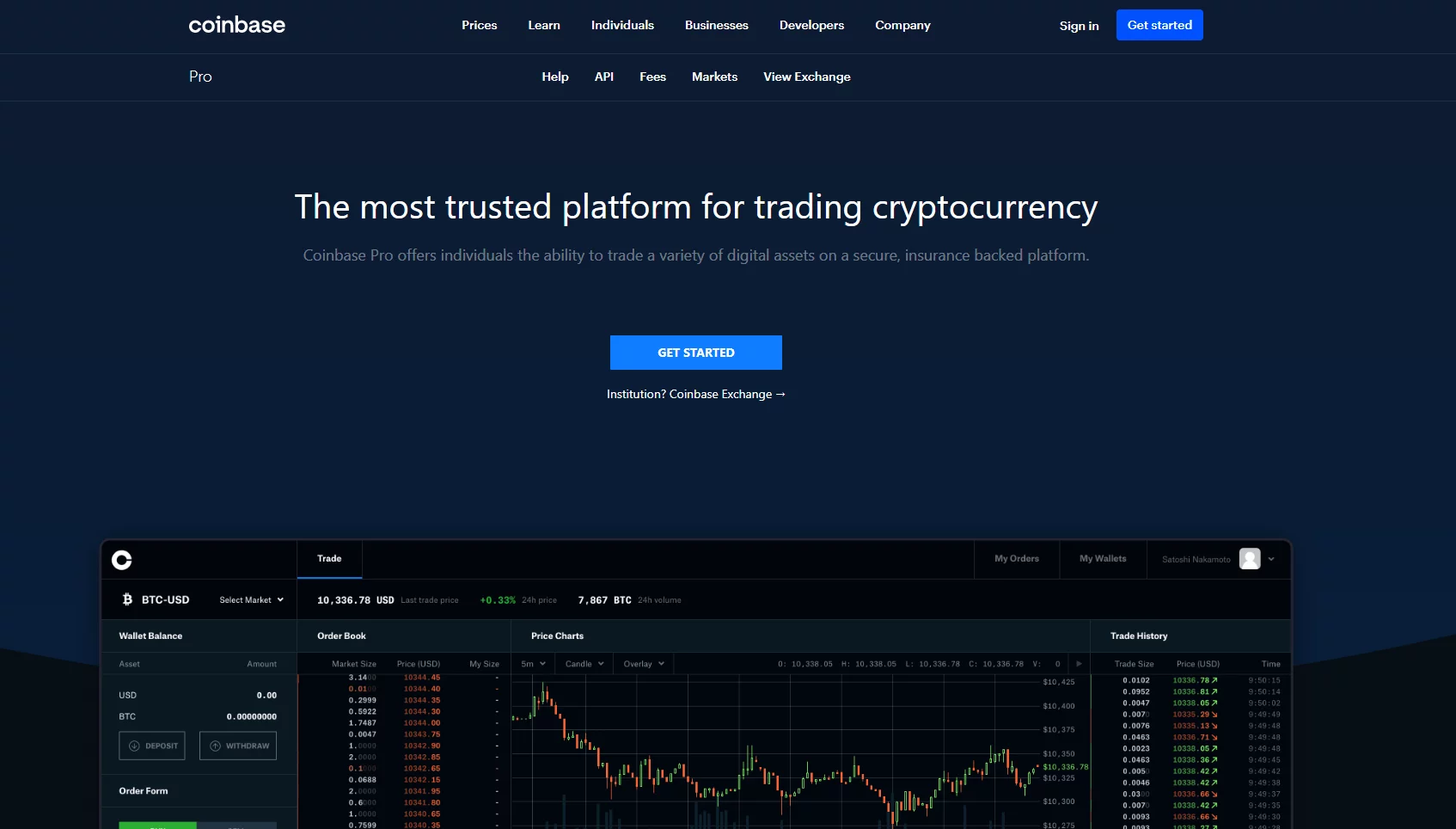

There are two Coinbase trading platforms. The first is the regular Coinbase website. This platform is the easiest way to buy, sell, or convert cryptocurrency. Coinbase Pro is the second trading platform. This is a separate site and is best suited for experienced traders.

Opening an account

To open an account with Coinbase, you must meet certain requirements, which are:

- You must be 18 years or older.

- Have a government-issued ID. Coinbase does not accept passport cards.

- Have a computer or smartphone connected to the internet.

In addition to those requirements, Coinbase recommends you have the latest version of your web browser, or the latest version of the Coinbase App.

If you meet the requirements, then setting up your Coinbase account is a fairly fast process. Head to the Coinbase website and click “Get Started”. From there you will be asked to provide your legal full name and email address. For Canadian users, you will have to enter the province that you live in. Next, you will create your own password. After you have entered in the information, click “Create Account”. You now have an account with Coinbase.

Verifying account

But before you can begin trading, you must verify your account. There are multiple tasks you will need to do in order to complete the process. First, you must enter the information shown on the ID you provided. This includes your first and last name, date of birth, and address. Next, you will be asked some questions:

- What do you use Coinbase for?

- What is your source of funds?

- Your current occupation?

- Your employer?

- The last four digits of your Social Insurance Number (SIN)?

After you have completed the first step, verify your email address by clicking the link sent to your account. The last step is to verify your phone number. All you have to do is enter the number, select your country, and enter the code Coinbase sends to your phone.

It may seem like the verification process is long and complex, but it actually is pretty quick. Coinbase guides you through each step, and the processing time did not take longer than other exchanges I have used.

Fees

Coinbase has some of the highest fees in the crypto industry. Here is a quick breakdown of the trading fees:

- $0.99 for trades of $10 or less.

- $1.49 for trades between $10-$25

- $1.99 for trades between $25-$50

- $2.99 for trades between $50-$200

For trades above $200, fees are calculated using a percentage base. Buying crypto with a credit/debit card comes with a 3.99% fee, which is one of the highest fees charged by any crypto exchange. Even the advanced trading platform has expensive fees. Coinbase Pro uses a maker/taker fee for trades, which equals 0.50%. This is much higher than the fees found on other advanced trading platforms like Kraken Pro.

I had difficulty finding information about Coinbase’s fees. The website does not have chart listing the various fees. So, I went to other websites to find the information.

Funding your account

Unlike other crypto exchanges I have used, Coinbase does not allow Canadian users to fund their account with actual fiat currency. Instead, you must link a debit or credit card. Thankfully, linking the card is a simple process. Go to Setting and click on the Payment methods tab. You will see two options, one for PayPal and one for credit/debit cards. PayPal is used for withdrawals only. Once you select the credit/debit card option, you enter in the card’s info, like the number, CVC, and expiration date. Click Add Card to submit the info. Your card should immediately appear on the menu screen. You are now ready to make some crypto purchases.

Screenshot taken from Coinbase.

To fund my account, I deposited some Bitcoin I have in a separate crypto wallet. The process was similar to other crypto exchanges. I clicked the Send/Receive tab and selected the receive option. I chose my asset I wanted to deposit and copied the crypto address. The Bitcoin was sent to my account a few minutes later. This was one of the shorter deposit times I have experienced.

Trading experience

I found Coinbase very easy to use. I only used the Convert feature; I exchanged some Ethereum for Bitcoin. The whole process took just a few clicks and was completed in less than a minute. Withdrawing and depositing cryptocurrency from Coinbase was also a painless process. I instantly deposited Bitcoin to my account, and it took about 30 minutes for my withdrawal to complete.

Additional features

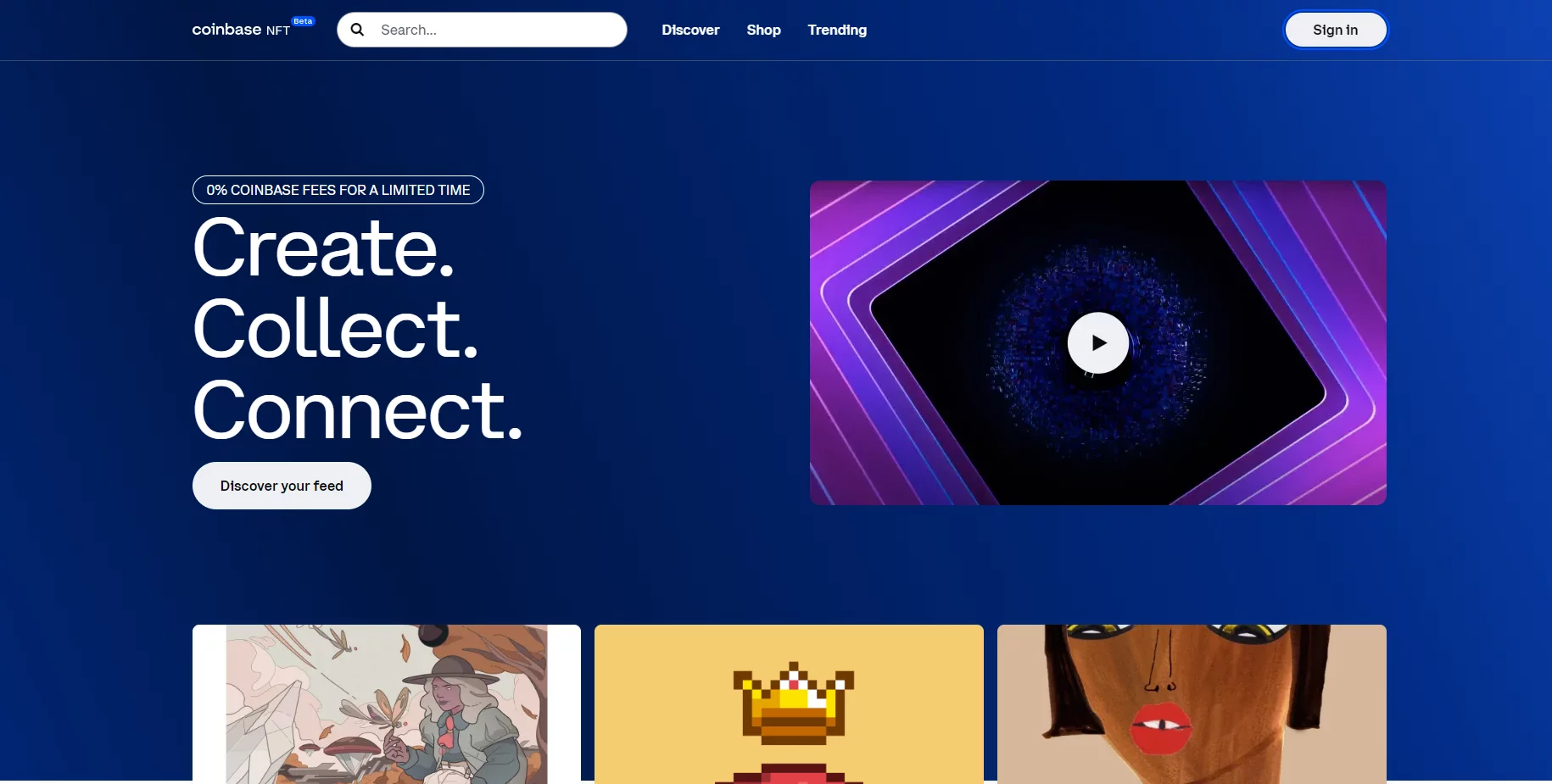

I did explore the additional platforms Coinbase offers, like Coinbase Pro and Coinbase NFT. For Coinbase Pro, you need to set up a new account to use it. To use Coinbase NFT, you need to link your Coinbase Wallet to the site. Both platforms can be confusing for beginners. Coinbase Pro can certainly intimidate new crypto traders. The site is filled with complex financial charts and statistics. While Coinbase NFT has a much simpler interface, those unfamiliar with NFTs may find the site confusing. I did not use the either platform. Since I am relatively new to crypto trading, I found both sites to be confusing and tricky to use. But more experienced people should enjoy the features of each platform.

- Coinbase Pro homepage

- Coinbase NFT homepage

Pros and cons

Here are some of the positive of using Coinbase:

- Simple Interface: Out of all the crypto exchanges I have used, Coinbase has one of the simplest web interfaces. You can easily find what you are looking for whether it be the buy, sell, or convert feature. At no point was did I have difficulty finding my way through the website.

- Learning Resources: Like other crypto exchanges, Coinbase has learning resources to help you better understand crypto currency. Plus, they have tutorial articles explaining their services; for example, “How do I cash out my funds?” To access these resources, click on your account icon and select Help. Then click on Coinbase from the Products list.

- Extra incentives: Coinbase has several features that let you earn free cryptocurrency. The first is their Learn and Earn program. All you have to do is watch a few crypto tutorial videos and complete a short quiz. Once you have done that, you will be rewarded with a small amount of cryptocurrency. Another feature is the Coinbase’s referral program. For this program, you invite friends to sign up with Coinbase. Once they buy or sell $128.36 CAD (Canadian dollar) worth of crypto, you both receive $1.84 in Bitcoin. The last feature to mention is the mobile wallet link. If you have Crypto Wallet on your phone, you can link it with your Coinbase account and receive $5.19 in ETH. All of these features are great ways to get free cryptocurrency, and they are an extra incentive to sign up with Coinbase.

However, there are some cons to using Coinbase in Canada:

- Restricted payment methods: Canadians are restricted in how they can buy cryptocurrency on Coinbase. As I mentioned earlier, Canadians can only use their debit/credit card for purchases. For users who like multiple payment methods, this restriction may be a major dealbreaker.

- High fees: Coinbase has some of the highest fees in the crypto industry. For purchases, Canadians have to foot a 3.99% fee when using their debit/credit card.

- Unclear fee information: Coinbase does not clearly state the fees it charges. Most exchanges have a section in their Help page that lists the fees for buying, selling, trading and withdrawing/depositing crypto. But with Coinbase, you will hard pressed to find a fees chart. The only way you find out what the fees are is when you make a transaction; the figure will be listed.

Concluding thoughts

I found Coinbase to be very easy exchange to use. I had no issues transacting cryptocurrencies on the site, and I was able to navigate the site easily. I also liked the incentives you can get by using Coinbase. I linked my mobile Coinbase wallet and received $5.19 worth of Ethereum in return.

Unfortunately, that is where the positives end. I do not think Coinbase is the best crypto exchange for Canadians, which is due to the three cons I mentioned above. If Coinbase provided more options and features for Canadian users, then I might have enjoyed my experience more. But unfortunately, I do not recommend Coinbase to Canadians, based on their high fees and lack of payment options

Frequently asked questions about Coinbase

Is Coinbase safe?

Coinbase has many security measures in place to keep your crypto assets safe. All accounts must have multi-factor authentication (MFA) in place for things like logging on or transferring funds. Coinbase allows multiple MFA methods. The most common method is to use your mobile phone. The more secure methods are to use an authenticator app or a security key. If you think your account has been hacked, you can lock it, which freezes all transactions. Coinbase uses cold storage for 98% of customer assets. The cryptocurrency is held in a network of offline safe deposit boxes located around the world. These boxes have digital and paper backups.

All of these examples show that Coinbase is a safe exchange. With that being said, users can still fall victim to hackers. Make sure you keep your account information provide. Also be on the lookout for phishing attacks and other hacking schemes.

Is Coinbase good for beginners?

Coinbase is a great exchange for new crypto traders. The simple users interface makes crypto transactions simple and easy. Plus, beginners should have no problem navigating the site. Lastly, all the complex crypto terms are easy to understand; they are written in plain language.

How do I withdraw crypto funds to my bank account?

Withdrawing your crypto assets from your Coinbase account to your bank account is similar to other cryptocurrency exchanges. The first thing you must do is sell off your cryptocurrencies. Once you have received the funds, you can select the transfer method. Coinbase does not allow direct bank transfers for Canadian users. Instead, Canadians can use PayPal to transfer their funds out of Coinbase and to their bank account.

How do I transfer crypto from another exchange to Coinbase?

To start, click the Send/Receive tab at the top of the homepage. Click on Receive and select the type of cryptocurrency to want to deposit. Coinbase will generate your account address. Copy the address and sign into your other crypto exchange. From there, go to the withdraw menu, select the crypto coin and the amount you want to send, and enter your Coinbase address. The transaction should be completed in 30-60 minutes.

What are Coinbase phishing scams?

Phishing is a cyber attack commonly used by hackers to gain access to your money or personal information or install malicious software (like ransomware) onto a person’s device. Phishing attacks usually come through email, telephone or text message. The attacker poses as a legitimate institution asking you to provide personal information like a credit card number or account password. Phishing scams have five characteristics:

- Sense of Urgency: Most phishing scams will create a sense of urgency in the message. For example, the email might say that you need to click on the link in the next 30 minutes in order to claim a cash prize. Another common example is that your account will be locked unless you update your personal information immediately.

- Attachments: Many phishing messages come with an attachment. These can be pdf, word, or jpeg files. You will be prompted to open the file. While the file may look legit, they actually are carriers of ransom and other computer viruses. Once you open the file, the virus will install onto your computer. Only open documents that are a .txt file.

- Hyperlinks: Almost every phishing scam will include a hyperlink, which you will be directed to click on. The URL will appear to be correct, and it could send you to what appears to be the correct website. However, the URL will have misspelling. For example www.tangerin.ca (missing the e).

- Unusual sender: The sender of the message will usually claim to be from a legitimate organization, like CIBC or the CRA. It’s always a good idea to check with the real organization to see if they sent a message.

- Unusual offers: Often times, phishing messages will have offers or deals that are too good to be true. Cash prizes, free tablets, or vacation deals are some common examples.

When receiving a message from Coinbase, keep those five characteristics in mind. Nine time out of ten, the message will be from the real Coinbase. However, there is always the chance that a hacker will use Coinbase as a cover for their phishing attack. Overall, if the message is unexpected or seems unusual in any way, it is probably a phishing scam.

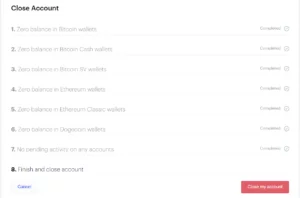

How do I close my Coinbase account?

Closing your Coinbase account is a relatively easy process, but there are a few things to know before you begin. First, make sure your account balance is $0 before you start. If your balance is too small for transactions, you can dispose of it by:

- Sending it do a different Coinbase user

- Donate it to org, a non-profit that gives crypto to people living in poverty

- Allow Coinbase to zero out the remaining balance by forfeiting the funds.

My remaining balance was $0.02, which was too low to perform transactions. I ended up donating my balance to GiveCrypto.org.

The second thing you should now is that your Coinbase Pro account will also close when you close your main Coinbase account. Lastly, closing an account can only be done on a web browser.

To start the process, go to Settings and click on Activity. Scroll to the bottom of the page were you will see the Close Account tab. You will be prompted to enter your password. You will then see a checklist of the requirements you must meet in order to close your account. If all the requirements are met, click on Close my Account. You will get an email notifying you that your account was successfully deleted.

The checklist for closing an account. Taken from Coinbase.

Is Coinbase publicly traded?

On April 14, 2021, Coinbase became a publicly traded company. Investors were now able to buy shares of the company directly from the Nasdaq stock exchange. At the end of the trading day, Coinbase shares were valued at $328.28 U.S. This price rose Coinbase’s market cap to $85.8 billion U.S.

As of May 2022, Coinbase’s stock has fallen to $61.394 U.S.

Read more

How to Buy Bitcoin in Canada: Step by Step

Here’s your full guide on everything Bitcoin.

TFSA vs RRSP: Comparing the Two

A TFSA and RRSP are two ways to save money. This article will compare the two accounts.

How to Save Money: 25 Top Money Saving Tips

Learning financial literacy can be hard, but we all need to start somewhere.

CryptoTab Browser Review: Features, Pros and Cons

CryptoTab Browser makes crypto mining easy. Check out this review to learn more.

names of prescription allergy pills prescription allergy medication without antihistamines names of prescription allergy pills