The Best Ways to Fight Inflation in Canada

Since the beginning of 2022, the price for gas, groceries, and other consumer goods has steadily increased. Certain food items command expensive prices and filling up your car with gas can cost a fortune. The culprit behind this price gouging is inflation. As of December 2022, the Canadian inflation rate is at 6.3%, a level that hasn’t been seen in 40 years. As inflation continues to run rampant, your top priority should be protecting your finances. This article will list some of things you can do to combat the effects of inflation. The following strategies will help you save money during inflationary periods. We’ll also provide a forecast for what inflation this year could look like.

Save on groceries

Source: Rank-It.ca

Groceries were probably affected the most by 2022’s inflation hike. Items that were $5.00 at the beginning of the year shot up to $7.00 by December 2022. Some Canadians have said they can barely afford groceries and have had to take drastic measures to make things work. I have also felt the sting of high food prices. Over the past five months, I’ve seen my grocery bills steadily rise. Thankfully, there are things you can do to lower your grocery bill. The following tips are not a one stop solution, but they will lessen the blow.

The first thing you should do is develop a grocery list. Write down the essential items you’ll need for the week. Creating a list will help you cut out unnecessary items, things you can go without. This will help lower your grocery bill. I’ve started to use grocery lists, and it has helped me save money. Instead of splurging on candy or chocolate milk, I’ve learned that I don’t really need these times (even though it took lots of willpower).

Whenever possible, buy items in bulk. This doesn’t work for every product (some have shorter shelf lives), but condiments, dried goods, canned foods, and spices are good items to buy in large groups. The initial purchase will be high, but the items will last for a long time. Plus, your kitchen pantry will be stocked for several months, which means you won’t have to buy as many items each week. I like to stock up on spices, rice, pasta, and canned vegetables. These items will last for at least a month before I have to restock them.

Meat and seafood have become one of the most expensive items to buy. To avoid these high prices, try buying cheaper cuts of meat. The quality may be a little less, but you’re saving more money. Pork and steak are usually pricier, so opting for chicken instead can be more affordable. You can also try eating more plant-based meals. For the protein, use beans or lentils instead. But if you’re not ready to say goodbye to meat, consider buying a freezer pack from a butcher’s shop. A typical pack will contain 2-6lbs of beef, pork, and chicken and will cost you between $100.00-$400.00. This does seem like a turnoff, but the investment is worthwhile. The pack can last for several months, which means you won’t have to buy meat as often. Just make sure you eat everything in the pack, otherwise it will go to waste. You’ll also need a big enough freezer to store the meat. Chest freezers are the ideal size, but some models are expensive.

Fresh produce is another pricey item at the store. One way to save money on produce is to buy frozen fruits and vegetables. Most of these products are priced $1.00-$2.00 lower than the regular version. When I first learned about this tip, I did not think it was a good approach. I assumed that frozen produce was inferior in terms of quality and healthiness. In reality, frozen fruits and veggies are often packaged at peak freshness. There is no major drop off in quality and nutrition. Frozen produce also lasts longer, which cuts back on food waste.

There are other simple things you can do to save money on groceries. Buy products when they go on sale. Flyers and mobile apps list the items on sale. Some grocery stores have store-wide sales. On the first Tuesday of every month, each item at Save on Foods is 15% off. Some stores price match certain items. For example, Real Canadian Superstore will reduce the price of a product to match the lower price from a competitor. While the difference may not be substantial, saving $1.00 – $3.00 on an item can go a long way. If you regularly shop at a grocery chain, sign up for a membership card. You can use the card to gather points on your purchases. The points will pile up, and eventually you will be able to use them to receive deals on groceries. Some cards let you use points to partially or fully pay for a vacation. I use the Save on Foods More Rewards card to gain points on my purchases. There have been a few times where I had enough points to receive free items.

Sometimes, the best thing to do is shop at cheaper grocery stores. The quality may be a bit lower, but you will be saving more money. Costco and Walmart might be the cheapest options for Canadians. I’ve also made the switch to cheaper stores. For many years, I shopped at Save on Foods. Their prices have typically been higher than most competing stores, but I was always able to manage. However, by June 2022, shopping at Save on Foods became too expensive. I switched over to Real Canadian Superstore and saw an immediate difference in my grocery bill (about $2.00-$3.00 cheaper).

Food banks another great source of affordable food. While some people might feel embarrassed with visiting a food bank, there is nothing to be ashamed about. The mission of Food Banks Canada is to be a source of food for those in need. And millions of Canadians are visiting food banks already. In March 2022, 4,045,013 meals and snacks were served, and there were close to 1.5 million visits to food banks. These figures show that food banks are an essential service for millions of Canadians.

Save on gas

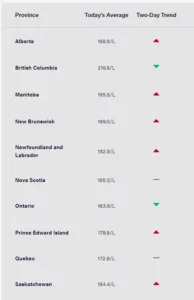

Gas was already expensive before the 2022 inflation spike made things worse. Many provinces have seen record high gas prices. As of October 2022, drivers in British Columbia are paying the most at the pump: 223.4/L.

Average gas price per province as of October 13, 2022. Source: Canadian Automobile Association

Gas prices can fluctuate from week to week or month to month. In September 2022, gas in Alberta fell to 129.0/L. At the beginning of October, prices shot up to 163.1L. December 2022 saw some relief as prices gradually lowered, but experts expect prices to go back up in January 2023. Because of this fluctuation, timing when you go to gas up is crucial. According to Canada Drives, gas prices usually rise around Thursday. Therefore, try to fill up at the beginning of the week

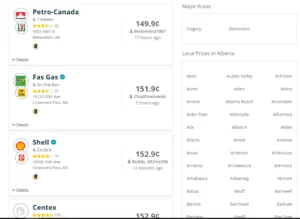

Most gas stations will differ in their prices. Some will only be by a few cents, while others are cheaper by $2.00. To find the cheapest gas stations in your area, use a gas price tracking app. Users will regularly update the prices. I’ve used GasBuddy many times to find the cheapest station in my area. Some gas companies have membership clubs that offer savings on fuel purchases. Petro Points (from Petro-Canada), Esso Extra, and Shell Fuel Rewards are some examples.

A list of the lowest gas prices in Alberta as of October 6, 2022. Source: GasBuddy

Taking public transit more often is a great way to save money on gas. I take the bus to work everyday, which has lowered my gas expenses. Cycling or walking to places are also good ways to curb your gas bill. However, some of these tips are not feasible for everyone. Some people do not have easy access to bus routes, or the destination may be too far away to walk/cycle to. If that’s the case, try car pooling with friends or coworkers when you can.

Your driving habits can impact how much you spend on gas. Aggressive driving (speeding, sudden braking, quick acceleration etc.) burns gas quicker, which means you’ll be at the pump more. Driving calmly and sensibly will boost your gas mileage. Making sure your car is in tip top shape will also improve your gas mileage. Fully inflated tires and a tuned-up engine help your car efficiently use fuel.

Reduce expenses

Reducing your monthly expenses can be a difficult task. But with a little hard work, you can shrink your spending and increase your savings. Start by reviewing your monthly bills to see how much you’re spending on certain products and services. From there, separate the items into two categories, essential and non-essential. Eliminating unnecessary expenses will lower your bills. For example, I canceled my subscription to the sports streaming service DAZN. I use it to watch NFL games, and the season only lasts for about four months. After cancelling my subscription, I shaved $25.00 off my monthly bill.

If possible, do not make any expensive purchases. Paying thousands of dollars for a smart TV or new car will do plenty of damage to your budget. Not having extra cash hand will make it harder to pay those monthly bills. Once inflation subsides, you can buy those big ticket items. I’ve wanted to buy a new electric guitar and amplifier for several months, but both items cost hundreds of dollars. For now, I’ve put buying these items on the back burner until the economy improves.

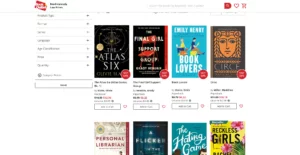

Like I mentioned for groceries, buying certain products from discount stores is great way to save money. You can find second hand clothing at Value Village, while Habitat for Humanity is full of donated furniture, appliances, and renovation material sold at discount prices. I recently bought books from an online store called Book Outlet. The site buys excess inventory from publishers and resells them at a lower rate. The books I purchased had up to 63% taken off their regular price. Four books cost me $53.55 CAD, when it would normally cost me over $100.00 for the same purchase.

Source: BookOutlet

If buying second hand items is not your thing, store wide sales are the way to go. Many stores have clearance sales in which products are sold at marked down prices. I’ve often bought clothes during clearance sales, saving at least $50.00 CAD in the process.

Invest wisely

When inflation is high, it might not seem like a good time to invest. However, you can still set up investments during periods of inflation. You just have to make smart decisions. Avoid volatile commodities like cryptocurrency, where prices can fall by thousands of dollars in a matter of days. Inflation hit the crypto market hard in 2022, with several coins falling in value. Bitcoin started the year at $60,442 CAD. When inflation began to take hold in June, its price fell as low as $24,913 CAD. If you still want to invest in cryptocurrencies, stablecoins are a safer option. They are pegged to traditional assets like gold or money; this helps stabilize their price. Cheaper coins like Cardano or Dogecoin are also good alternatives.

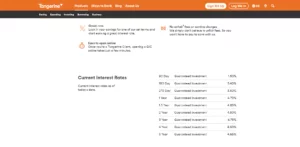

According to Rate Hub, assets with greater price control are better investment options. Bank stocks, oil, and steel are some of the best commodities to invest in during times of inflation; their prices rise naturally with inflation, which gives them pricing power. If you want an even safer investment option, consider a GIC. They are secure investments that guarantee a 100% return of the principal (the original money you invested) plus the accumulated interest. Each bank will have their own GICs. You can also set up a GIC with an online bank. Rates tend to be higher; a one year GIC with Tangerine has a 4.70% interest rate.

The interest rates for a Tangerine GIC. Source: Tangerine

Having a diverse portfolio of investments is also key. You’ll have multiple areas to earn money in and fallback options when one investment doesn’t work.

No matter how bleak the market looks, do your best to stay the course. There will always be rough patches in investing, and 2022 was just another example. There have been many times in history when the market rebounded after a lackluster period. As long as you invested your money wisely, you should see a return down the road.

Tackle debt

Paying off loans is difficult by itself. The task becomes even harder when inflation rates are high. Your finances will already be strapped due to the high prices for goods and services. Additionally, interest rates will make things harder. This why several financial experts recommend clearing personal debt immediately during periods of inflation. If you have multiple debts, pay off the one with the highest interest rate first. Payday loans tend to have the highest interest rate, with some reaching 500%. After you’ve tackled your largest debt, move to the next biggest one.

Sometimes you won’t have enough money to payback your debts. One way to generate more cash flow is to get a second job or start up a side hustle. But if you do not have the time or energy to work multiple jobs, having your bank perform a balance transfer could help with your situation. According to Forbes Advisor, a bank will transfer money to your credit card up to its limit. You can keep this balance on your credit card at 0% interest for six to 12 months. This will help you pay of your debts without the headache of high interest rates.

Cash back credit cards

Using a cash back credit card can help put money back into your pocket. For every purchase you make using the credit card, you will get a small refund. As you make more purchases, the balance will continue to grow. You can redeem the balance and use it to pay off your credit card bill.

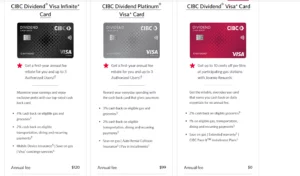

Cards will differ in how much money they return to the user. Lower end credit cards will have smaller return percentages, while higher end version have better rates. For example, the CIBC Dividend® Visa Card has 2% cash back on eligible groceries, and 1% on eligible gas, transportation, dining, and recurring payments. Compare that to their Visa Infinite card, which gives you 4% cash back on eligible gas and groceries, plus 2% back on other payments. I saw an immediate improvement on my cash back balance when I switched over to a higher priced credit card.

CIBC credit cards and their cash back rates. Source: CIBC

To make a cash back credit card worthwhile, use it to pay for most of your everyday expenses. Doing this ensures you will get the best rewards possible. Using my credit card for most of my purchases is something I’ve struggled with. I’m more used to using my debit card to buy things. However, once I made the switch, I noticed my cash back balance steadily grew. The balance grew even quicker when I got a better credit card. The only thing to be careful of is overspending. The cash back won’t be much of a reward if you’re stuck with an expensive credit card bill.

For more information on the best cash back credit cards, click here.

Conclusion

While inflation is a stressful time, just remember that it does not last forever. Typically, inflation last for about two years, after which the economy begins to stabilize. In the grand scheme of things, this is a short time frame. However, protecting your finances during this period should be your top priority. And who knows, the inflation period could last longer than anticipated. The tips listed above are tried and true ways to save your money during inflation. Even when conditions improve, practicing the methods above will go a long way in improving your financial situation.

Frequently asked questions about inflation

What is inflation, and how does it work?

According to Investopedia, inflation is an increase in the price for goods and services. The price change results in a decline in purchasing power, which is the value a currency holds in terms of the amount of goods or services it can buy. Another way to express this is that money will gradually lose its value, meaning you will be paying more for less. During periods of extreme inflation, wages will typically stay the same. This makes it harder for people to keep up with skyrocketing prices.

Inflation can be classified into three types: demand-pull inflation, built-in inflation, and cost-push inflation. Demand-pull inflation happens when consumer demand outpaces the supply of various products. As supplies dwindle, prices rapidly increase. The main cause for demand-pull inflation is increased spending by consumers. In cost-push inflation, the high cost of materials and wages cause the price increase. Producers struggle to meet the high production costs. In order to generate a profit, they raise the price for their goods. Lastly, built-in inflation occurs when wages increase in response to inflation. As wages get bigger, the cost for goods and services rises in return. This cause-and-effect cycle is called the wage-price spiral.

At its core, inflation is caused by an increase in the supply of money. This surplus is achieved in several ways:

- More money is printed and entered into circulation.

- A currency’s value is legally reduced by financial authorities (also called devaluing).

- Loaning new money into circulation as reserve account credits. This is done by purchasing government bonds from banks on the secondary market.

All three methods significantly reduce a currency’s purchasing power.

How is inflation measured/calculated?

Inflation is measured using the Consumer Price Index (CPI). Specifically, the CPI tracks the monthly change in prices consumers pay for goods and services. In Canada, the CPI divides goods and services into eight major areas (aka baskets):

- food

- shelter

- household operations, furnishings, and equipment

- clothing and footwear

- transportation

- health and personal care

- recreation, education, and reading

- alcoholic beverages, tobacco products, and recreational cannabis

The price for each of these baskets are measured over time. To find the price difference, the monthly cost of a basket is compared with the same month’s cost a year prior. For example, the overall rate for November 2022 rose by 6.8% over a 12 month period (November 2021 – November 2022).

Click here to view the latest CPI reports.

How do governments deal with inflation?

Each country’s government has an authoritative body responsible for controlling inflation. In Canada, the responsibility falls on the Bank of Canada. Their goal is to make inflation “low, stable, and predictable”. In other words, a target inflation rate (ideally at 2%) must be reached and maintained.

To achieve this, the Bank of Canada uses two methods. The first is to lower interest rates. In this method, the bank buys government bonds and other financial assets; this increases the price for each. As result, the interest rate bondholders receive drops. The lowering of this interest rate can cause other interest rates to fall. Now borrowing and spending money is much more cheaper. As the economy recovers and inflation starts to settle down, the bank will sell the bonds.

The second strategy is altering the interest rate the Bank of Canada charges to commercial banks. The rate is typically lowered to promote spending. Once the economy recovers, interest rates are raised to avoid steep inflation.

Traditionally, governments used wage and price controls to combat inflation. Wages would be increased to meet the increased costs. However, this sometimes led to a wage-price spiral. Price controls are the legal minimum or maximum price for certain products. They are typically used to maintain the affordability of goods and services. The effectiveness of this tactic is hit or miss. Some goods and services become more affordable. However, disruptions in the market, a drop in quality, and losses for manufacturers are some of the negative side effects. Wage and price controls are still used today, but some experts view them as ineffective.

Are there any positives to inflation?

As you may have guessed, inflation is bad for the economy. But you may be surprised that there are some positive sides to inflation. It all depends on the situation.

Tangible assets like property or stocked commodities see a rise in price during inflation. Those who hold stocks in those assets welcome the price increase because they sell their holdings at a higher rate. Speculative trading also becomes popular during inflation. Even though the risks are higher, investors expect better returns during this period. Lastly, inflation at an ideal level benefit’s the economy. When inflation is at a desired range, consumers are willing to spend more. This can help fuel the economy’s range.

Why is inflation so high in 2022?

The roots of 2022’s inflation period can be traced to the COVID-19 pandemic. When countries went into lockdown in March-April 2020, supply chains became strained. This was especially true for international trading. Shortages of certain goods occurred, causing consumer demand to rise and prices to increase. By early 2021, people were spending more money for several products. The situation was expected to improve as 2021 ended and 2022 began. However, Russia’s invasion of Ukraine in February 2022 put an end to those hopes. The war severely damaged an already struggling global supply chain. The price for energy and agricultural products rose sharply. The effect was most evident in the cost of groceries and gas. Many restaurants had to increase their prices as the cost for produce became more expensive.

Another source for the high inflation of 2022 was the demand for services. Because of the pandemic, people missed out on traveling or going out to bars and restaurants. As restrictions loosened, consumers flocked to their favourite businesses or vacation destination. This surge in demand cause and steep price hike. Hotels and camping sites became more expensive to book and eating at restaurant became less affordable. According to the Bank of Canada, the inflation price for services reached 5% by the summer of 2022. By June 2022, the Canadian CPI reached 8.1%. As I mentioned earlier, this figure dropped to 7.0% in August 2022. By the end of the year, the CPI reached 6.8%. Still, prices remain high, and Russia-Ukrainian war plus COVID-19 are still fueling this inflationary period.

What is the inflation forecast for 2023?

In 2023, the Bank of Canada expects the global inflationary pressure to ease. TD also believes inflation has peaked in Canada and price pressures should ease in 2023. As of October 2022, the price for oil, agricultural goods, and other commodities have started to fall from their record highs. The supply chain disruptions that plagued the global market in 2021 and 2022 have mostly been fixed. This improvement should lower the inflation rate. And the global economy as a whole gradually recovered as 2022 came to a close. Analysts from FocusEconomics predict the Canadian CPI in 2023 will average 3.4%. However, some experts warn that inflation will stick around. BMO economist Douglas Porter believes inflation will remain high through the first half of 2023.

How much will items cost in 2023?

For this question, we’ve identified three items that are affected the most by inflation in 2022. They are food, energy, and real estate.

Food prices will see little improvement in 2023. The war in Ukraine is still impacting the food market. Ukraine is a major producer of wheat sunflower oil, and fertilizers. Due to the conflict, there is a global shortage in those commodities. This supply shortage is one of the main reasons for soaring food prices. The Western sanctions on Russian exports has not helped the situation either. Consumers should expect food prices to remain high until the conflict ends.

As mentioned earlier, prices at the pump are expected to rise in January 2023. Some experts believe the average price for a litre of gasoline will reach $2.00 in several provinces. Experts believe supply limits will drive up demand, which will cause prices to jump. Gas prices should slightly lower by the end of April 2023 die to the federal carbon tax increase. However, gas prices will still trend upward. Natural gas is in a similar boat. While production has increased since late 2020, the supply has largely remained the same. With the prospect of supply increases looking slim, the inflationary pressure on heating costs will continue.

If there is one shining light for 2023, it’s in the housing market. The national average peaked at $816,720 in February 2022. But since then, the average has lowered by 22.5%. This trend is expected to continue for 2023. Desjardins predicts housing prices to fall by 20-25% from February 2022 to the end of 2023. However, some provinces are faring better than others when it comes to home prices. As of November 2022, the average sold price in Ontario was $829.934, while the average for Alberta was $422,709. BC also has expensive house prices; the provincial average was $906,785 for November 2022. This example shows that while prices have fallen, the cost of buying a home in certain provinces is still expensive.

Read more

What are Stablecoins?

Stablecoins are a growing part of the crypto market. This article will look at what stablecoins are and why they are worth buying.

The Best Robo Advisors in Canada

Take your investments up to the next level with robo advisors. An easy way to know which stocks to buy for the best return.

The Best Cryptocurrency Exchanges in Canada

Binance, Bitbuy, BitTrex and more: check the top crypto exchanges in Canada.

TFSA vs RRSP: Comparing the Two

A TFSA and RRSP are two ways to save money. This article will compare the two accounts.