A Guide to Retirement Planning in Canada

Retirement seems like a long way away when you first enter the workforce. It can be hard to imagine what retirement may look like for you. You may be tempted to put it on the back burner as you focus on your career. But it is important to start planning for your retirement at this stage of your life. Having a solid plan in place will help prepare you for your life after leaving the workforce. But knowing where to begin can be difficult. That’s why we created this article to cover some of the ways you can plan for your retirement. We’ll also cover some commonly asked questions on retiring.

Consider your retirement goals

To help visualize what your retirement might look like, think about some of the things you’ll want to do once you leave the workforce. Do you want to buy a vacation home? Do you plan on travelling across the world? Are there any new hobbies you want to pick up? Or are you planning to renovate your home? These are just some of the many things you can do in retirement, and each comes with a price tag. Once you have an idea of how you’ll spend your retirement, determining how much money you will need becomes easier. From there, you can start setting up a budget.

Of course, things can change over the years. As you near your retirement age, you might add more items to your bucket list. Or you may drop a few. Still, having a general idea of your retirement goals will help you plan for your post-work years. It gives you a sense of how much you’ll need in your bank account.

Develop a budget

Budgeting for the future can be difficult. However, it’s not something to put on hold. Having a set plan in place will benefit in the long run. Your retirement budget doesn’t have to be extremely accurate, but it should be reasonable. Finances obviously change once you retire. You won’t have to spend money on work-related expenses like bus or parking passes, dress wear, or various supplies. But at the same time, you might be spending more on things like travelling and other personal expenses.

Another thing to consider is your current budget. Chances are you don’t want to retire with little or no savings in your bank account. That’s why you should create a realistic budget for yourself now that lets you live comfortably until you retire. The budget should also leave room for you to start saving money for your retirement.

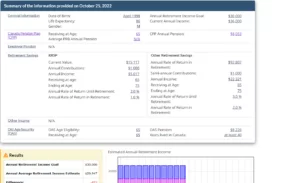

If you need help with setting up a budget, you can use a retirement income calculator. You enter various personal information: your current salary, total retirement savings, your pension plan balance, expected retirement age etc. Based on your information, the calculator determines your projected retirement income and your retirement savings goal (how much you need to save). You can find various retirement calculators online. All of the major Canadian banks have their own version. The calculator from the government of Canada website is one of the best versions available. Another good option is the calculator from Sunlife. These calculators provide detailed information to help you budget for your retirement. I tried out both, and they definitely gave me a good idea of how much money I should save for my retirement years.

Another useful budgeting tool is the budget planner from the government of Canada. This application creates a personalized budget for you based on your goals (e.g., saving more money) as well as your income and expenses information. The planner has three different categories: income, savings, and expenses. Based on the data you enter, the planner tells you about your financial health. This tool is very helpful. You get a sense of how much you’re spending in relation to your earnings and savings. Using the budget planner helped me create a realistic budget that cut down on my expenses.

Start Saving

Once you’ve developed a reasonable budget, you can start saving up. For Canadians, there are two registered accounts for saving money.

The first account is an RRSP (or Registered Retirement Savings Plan). It is a tax-advantaged account, which means the money you put in is not taxed by the government. Because of this factor, RRSPs are a great way for you to grow your money without some of it being eaten up by taxes. The only caveat is that taxes apply once you withdraw money from your RRSP. But by the time you’re ready to do so, you’ll be retired, and your income will be lower. This means your tax rate should be lower as well. The contribution limit for your RRSP is 18% of the income reported on the previous year’s income tax. A cap also applies, which in 2022 equalled $29,210. However, if you have not maxed out your contributions in prior years, you can make up the ground. For example, let’s say you have $20,000 of extra contribution space. You can pay that full amount plus the max contribution level for the corresponding tax year.

The second account is a TFSA (or Tax-Free Savings Account). Any contributions made to a TFSA can grow tax-free. Any money withdrawn from the account is tax-free as well. You can also hold investments like mutual funds, securities, and bonds in a TFSA. The gains made from these investments are not taxed by the government. Canadians 18 years or older can open a TFSA. The maximum amount you can contribute to the account is based on your personal contribution limit (called contribution room). This limit is set by the CRA. The contribution room for 2022 is $6,000. If you have any unused contribution room, it can be carried over to the following year. For example, let’s say you contribute $1,000 in 2021. The remaining $5,000 is carried over to 2022 and can be contributed in addition to the $6,000 limit. If you overcontribute, the CRA applies a 1% tax penalty per month to your TFSA until the excess contribution is withdrawn.

TFSAs and RRSPs are two great places to save your money for retirement. As long as you make regular contributions, you’ll have a large pool of money to draw from in your post-work years.

Learn more about TFSAs and RRSPs here.

Set up your retirement income

Once you leave the workforce, you’ll still need a regular source of money to live off. In Canada, retirement income generally comes from three sources:

- The Canadian Pension Plan (CPP)

- Old Age Security (OAS)

- The Québec Pension Plan (QPP)

We’ll break down each one of these pension plans below.

The Canadian Pension Plan

The CPP is a monthly benefit that replaces your working income. To qualify, you must be at least 60 years old and previously made at least one valid contribution to the plan. Any person 18 years or older working in Canada (excluding Quebec) with a minimum income of $3,500 per year can contribute to the CPP. The amount you can contribute is based on your income. The minimum contribution amount is $3,500, while the maximum amount is $3,499.80. The yearly contribution rate is 11.4%, which is split between you and your employer. In other words, both sides contribute 5.7% of your yearly earnings. If you are self-employed, the maximum contribution level is $6,999.60. You will have to pay the full 11.4% yourself. The amount of money you receive in retirement depends on various factors. If you applied for your CPP at an earlier age, the monthly amount will be lower. Contributing a higher amount means you’ll receive more money in retirement. Your average earnings during your working life also play a role. Generally speaking, the higher your income the greater your pension amount will be.

For more information on the CPP, click here.

Old Age Security

The OAS pension is a monthly payment you receive when you are 65 and older. Service Canada can automatically enroll you for an OAS pension. However, there are some cases where you’ll have to apply yourself. Payments start the month following your 65th birthday. The amount you receive depends on your income and how long you lived in Canada since you turned 18.

For more information on OAS pensions, click here.

The Québec Pension Plan

The QPP is similar to the Canadian Pension Plan. Québec Workers over the age of 18 with an annual income greater than $3,500 must contribute to the QPP. Since 1998, the minimum contribution amount is $3,500. In 2022, the maximum contribution level is $64,900. The total contribution rate for 2022 is 12.3%, split equally between employee and employer. Self-employed individuals pay the full amount. You can apply for the Québec Pension Plan once you turn 60. Just like the CPP, you will receive a higher pension if you apply for the QPP later in life. Your income and contribution levels also affect how much money you’ll receive.

For more information on the QPP, click here.

Contributing to your CPP or QPP is an integral part of retirement planning. The key is to start early and contribute regularly. Once you’re ready to leave the workforce, both pensions should give you a consistent revenue source. Combined with an OAS, you’ll be financially secure for your retirement.

Conclusion

There comes a time when you eventually say goodbye to the workforce. But until that time comes, you’ll need to prepare for it. The bottom line is that retirement costs money, regardless of your lifestyle. Whether you plan on travelling or spending most of your time at home, you’ll need enough money to live your retirement in comfort. And that’s where retirement planning come in. Following some or all of the strategies above will ensure you will be financially in your retirement.

Frequently asked questions about retirement planning

Why is retirement planning important?

Retirement planning lets you save up enough money so that you can live comfortably during your golden years. Not having a plan in place might mean you could be working well into your 70s. You might also be forced to work part-time jobs and other side gigs for extra cash.

When should I start retirement planning?

The general rule is that you should retirement planning as early as possible, i.e., the sooner the better. For most people, this will be in their mid 20s to early 30s. Planning early will give you time to build up your savings. Plus,

Who can help with retirement planning?

There are several sources you can use to help plan for your retirement. You can find many articles online from financial companies like Sunlife or from finance-related websites like Investopedia and Forbes. These articles are usually written by financial advisors or finance experts. You can also set up a meeting with a financial advisor at one of your bank’s branches. They will help create your budget as well as provide advice on investing and saving your money. I’ve met with a financial advisor on several occasions. After each meeting, I had a better understanding of my current financial situation and the steps I should take to grow my money.

How much money do I need for retirement?

The answer to this question depends on a person’s financial situation and goals for the future. Those who like to spend freely will need more money for their retirement, while frugal spenders will not need to save as much. If you plan on travelling or buying a vacation home in your retirement, you’ll need more money. If you plan on living a quiet retirement, you won’t need as much. Going over your future goals and current financial situation will help you determine how much money you’ll need.

At what age can I retire?

The standard retirement age in Canada is 65 years. This is the age when you become fully eligible for your CPP, QPP, or OAS benefits. However, being 65 years old is not a requirement for retiring. In fact, you can retire at any age, so long as you have enough money to live off of. For example, you can retire at 60 and still receive CPP or QPP payments. However, the payments will slowly decrease each month. If you start at a later age (e.g., 68), payments will increase every month.

With that being said, retirement can be a personal decision. If possible, some people prefer to retire early. My grandfather, uncle, and dad all retired in their late 50s or early 60s. And there are others who prefer to work well past 65. I’ve known some people who have worked into their 70s before retiring; they enjoyed their job and didn’t want to leave. Again, this decision is also influenced by your financial situation. If you have enough savings, then you can retire early. If you still need money, you might be working for a longer time.

nothing special